Should I Buy Ethereum, or Am I Missing the Elephant in the Room?

There is so much going on with the Bitcoin halving and new people entering the crypto space, one hardly knows where to look. If you have seen my recent article you will know that many market analysts are saying the Mac Daddy of Crypto (BTC) is likely to go up with all the recent demand from the commercial sector etc….. however once that party has started what will happen next? Many believe the money may then flow into the main bluechip coins like Ethereum (ETH) …. but then what?. The real money is to be made in getting ahead of the HERD and picking the next big winner…. however, perhaps the real money is not to be made in ‘getting ahead of the HERD’, but in fact ‘joining the HERD’…..?

Whether you’re a seasoned crypto investor or a curious newbie, I hope you will find the following informative and entertaining, as I’ll explain the differences and similarities between Ethereum and then possibly one of the greatest, most innovative coins to hit the market in recent years. Yes, I said ‘years’ as this goliath of the crypto jungle has been around for THREE years and continually beating out Bitcoin and punching well above it’s weight (even if it is named after the biggest animal in the jungle) and that coin is of course… the Elephant Money Token and their accompanying community, known as the ‘HERD’. If you have not heard of Elephant.Money yet, now is your chance!

So let’s look at these coins side by side. No boring technical jargon or complicated math here, just plain and simple facts and fun.

Let’s Compare:

Ethereum and the Elephant Money Token are both store-of-value assets, which means they are designed to preserve and increase their value over time. But they have different ways of achieving this goal, and they offer different benefits and risks for their holders. To help you understand them better, I’ll compare them from three key aspects: supply, stability, and security. These are the factors that affect the price, performance, and potential of these coins, and they are important to consider before you invest in them.

Supply

Let’s start by looking at how many coins these two bad boys have, and how that makes them more or less expensive and rare.

Ethereum has a flexible supply that changes depending on how busy and pricey its network is. It’s not like Bitcoin, which has a limit on how many coins it can make. Instead, it has an neat feature called EIP-1559 that destroys some of the fees, making the supply go down. This means that Ethereum can become more scarce and valuable over time, as more people use its network and services. But this also means that Ethereum’s supply is a bit of a mystery, as it depends on the market and the actions of its users. Right now, Ethereum has about 120.18 million coins, and the yearly growth rate is around 6.00%

The Elephant Money Token on the other hand has a huge supply of 1 quadrillion tokens. It has a 10% fee on every transaction that gives rewards to holders and locks liquidity, making the supply go down over time. This means that the Elephant Money Token can also become more scarce and valuable over time. As more people seek the rewards and products Elephant.Money provides the Treasury (Bertha) locks up more and more tokens. Unfortunately for Elephant Money the uninformed investor may look at the fee and be scared off investing; that is until they get to know what is going on ‘under the hood’. There is a bit of a learning curve, but having invested myself I can assure you it is worth digging a bit deeper to see how amazing this protocol is. Many investors do not know how the Elephant Treasury (Bertha) accumulates tokens (and is a friendly whale that will never dump)… but when they do, they hang onto their tokens for dear life.

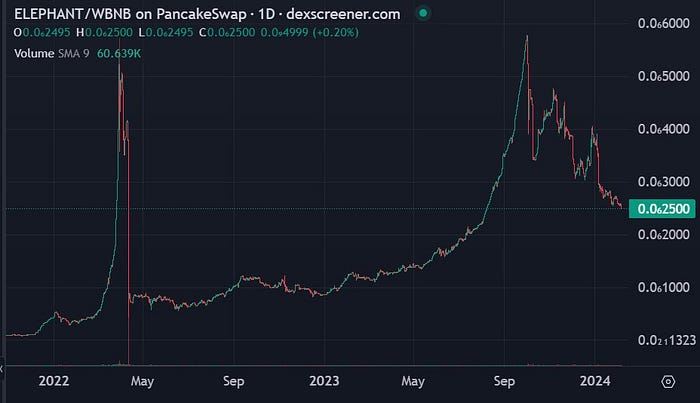

Because the coin is not on any centralized exchange it runs on pure math baked into the Elephant Money’s tokenomics. This sets out a path whereby the token should increase in a parabolic manner overtime, whereas the liabilities will be more linear. As such, many investors believe the token will continue to trend upward towards yet another parabola rise (an exploit and human holders selling stalled the last two parabolic rises). See the first two parabolic rises below:

Stability

Next up, let’s see how stable these two coins are. How much do they go up and down, and how do they deal with market changes and shocks?

Ethereum is more volatile than Bitcoin, as it depends on the demand and supply of gas, the network’s traffic, and the innovation and competition in the decentralized finance (DeFi) sector. Gas is the fee that users pay to do transactions and smart contracts on the Ethereum network, and it changes depending on the network activity and the difficulty of the operations. When the network is jammed, users have to pay more gas fees to get their transactions done faster, which can push up the price of Ethereum. On the other hand, when the network is quiet, users can pay less gas fees, which can lower the price of Ethereum.

The DeFi sector is another reason for Ethereum’s volatility, as it is always changing and bringing new products and services that use Ethereum as it’s platform. These products and services can add new demand and supply forces for Ethereum, as well as new risks and chances for investors and users. The current volatility of Ethereum over the last 60 days is 2.24%

Elephant Money Token can also move up and down however, it adds some stability through its link with BUSD (although it is being sunsetted it will still be honored by Binance for the foreseeable future), a stablecoin, in its liquidity pools. BUSD is a cryptocurrency that is tied to the US dollar, meaning that one BUSD is always worth one US dollar. By having some of its liquidity pools backed by BUSD, the Elephant Money Token can lower its risk to price changes and keep a relatively stable value. The Elephant Money Token also rewards holding (or Hodling), as holders get passive income from the fees. On top of that they are rewarded by way of yield thru Elephant Money’s various front of office products (such as their ‘Futures’ offering)

Security

Ok, let’s check out how secure these two coins are. How well do they protect themselves from hackers, attackers, and general bad guys?

The Ethereum blockchain is pretty secure, because it uses a bunch of math and cryptography to make sure that no one can mess with the transactions or the data. It also has a large and diverse community of validators who keep the network running.

The smart contracts are the programs that run on the Ethereum blockchain. They can do amazing things, like create tokens, games, and decentralized exchanges, however they can also have bugs or flaws that hackers can exploit.

Since moving from PoW (Proof of Work) to PoS (Proof of Stake), one could say the system has become more secure where validators lock their coins to secure the network and get rewards. PoS is supposed to make Ethereum use less energy and be better for the environment, as well as make it faster and smoother. PoS has also added new security features, like slashing, which punishes bad or faulty validators by taking away their stake.

The Elephant Money Token on the other hand is secured by the Binance Smart Chain (BSC), which is a PoS network that uses the security and decentralization of the Binance Chain. Binance Chain is a blockchain network that runs on a delegated PoS (DPoS) system, where a few validators are chosen by the community to make blocks and secure the network. BSC is a side chain that adds more features to Binance Chain, like smart contracts and compatibility with Ethereum. BSC gets the security and decentralization of Binance Chain, as well as the benefits from the big and active user base of Binance, the world’s biggest cryptocurrency exchange. BSC also has faster and cheaper transactions than Ethereum, making it more appealing for DeFi applications and users.

The Elephant Money Token also gets help from the audit and verification of its smart contracts by CertiK, a top blockchain security firm. CertiK does a thorough and tough analysis of the code and logic of the Elephant Money Token, making sure that it has no holes or bugs.

So, let’s sum this puppy up….

I know most of you would like me to say which one (or both of these) you should invest in because it is ‘absolutely’ going to make you rich, however that is not going to happen I am afraid :(

Unfortunately the crypto shop is all out of crystal balls, so we are all going to have to do our own research to figure this one out. I do however hope you had fun reading this article, and learned something new and useful about Ethereum and the Elephant Money Token, two of what I consider to be the most amazing crypto currencies in the crypto space. As you can see, they are both store-of-value assets, but they have different strengths and weaknesses, and they offer different opportunities and challenges for investors and users. Ethereum is the old and wise network, with a lot of innovation and potential, but also a lot of volatility and complexity. Elephant Money Token is the relatively young (up and running for the past 3 years) and fresh project, with a lot of rewards, accessibility, and ground breaking innovation — not to mention a track record of parabolic rises …. and possibly another just around the corner?…. The real ‘Ace in the hole’ that appears to separate the two is that Elephant.Money has a ‘Bertha’ (it’s Treasury). Unlike Ethereum, Bertha has the ability to propel the token to astronomical heights if everything pans out as BT ( Bankteller — the developer) intended.

Which one is better for you depends on what you’re looking for and what you’re willing to risk. You can also invest in both, and enjoy the best of both worlds. The choice is yours, but whatever you decide, make sure to do your own research and analysis, and don’t invest more than you can afford to lose. Crypto is a wild and wonderful world, but it can also be unpredictable and risky. So be smart and careful, and have fun with your investing!

Thank you,

Q,

Noisy Elephant

_______________________________________________________________

PLEASE FEED THE ELEPHANTS :) If you like this information please consider clapping and following this channel and/or saving yourself 1.5% on Elephant transactions (8.5% instead of 10%) by adding me as your Partner on Elephant Money (0x4F570AFEA2d03c47A2cE622Bf25CE293cC189Fda)

_______________________________________________________________

Disclaimer: This article serves educational and entertainment purposes only. It does not constitute financial advice, and investing in cryptocurrencies carries inherent risks. Conduct thorough research and seek professional advice before making financial decisions in the volatile cryptocurrency market. The author’s views do not necessarily reflect the official stance of any organization or entity.